Unlocking the Value of EPCs Why Mortgage Companies in Stroud Rely on Energy Performance Certificates

The Role of EPCs in the Mortgage Industry

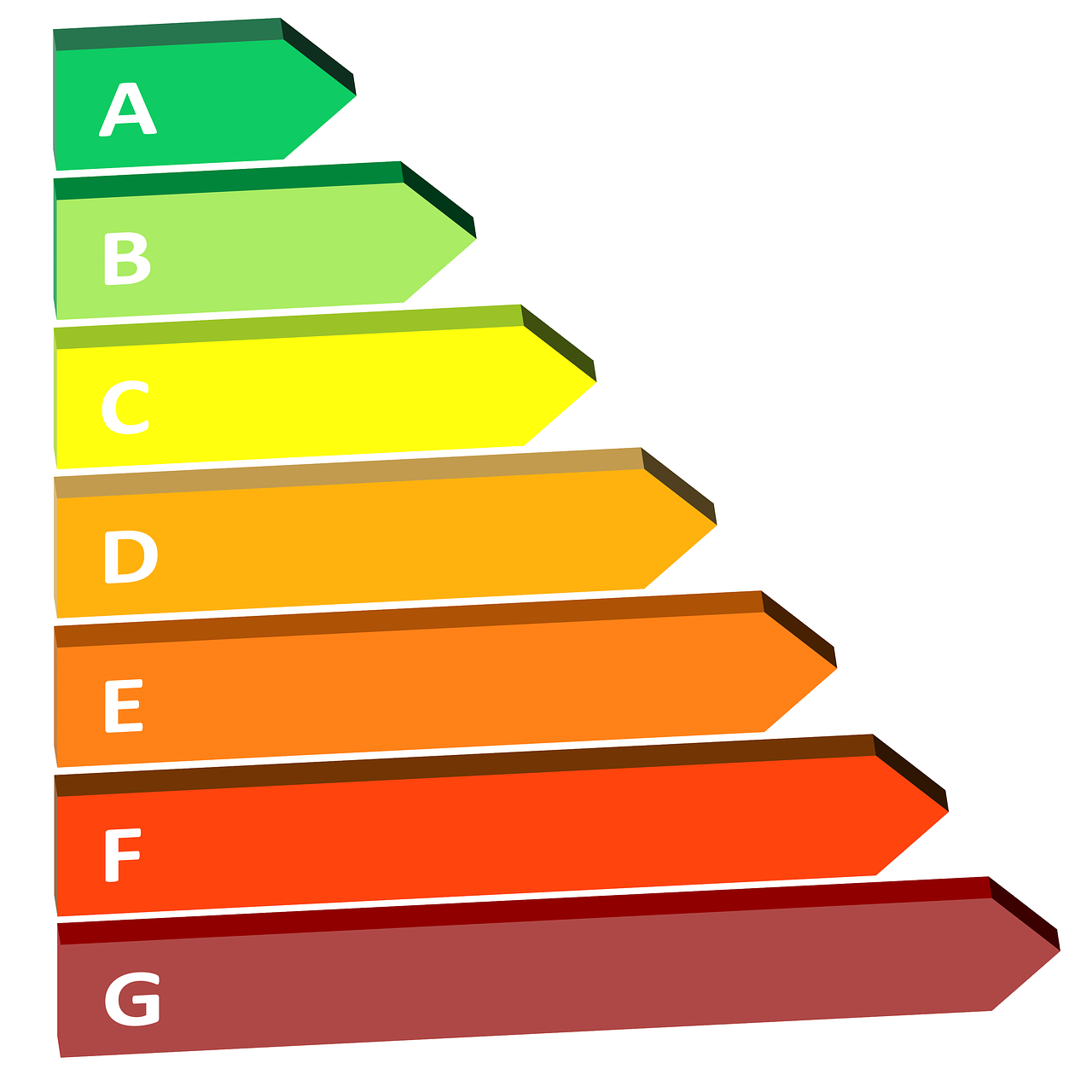

EPCs play a crucial role in the mortgage industry. Mortgage lenders require borrowers to provide an EPC before approving a loan. This requirement ensures that borrowers are aware of the energy efficiency of the property they are purchasing. It also helps mortgage lenders assess the risk associated with the property. A low energy efficiency rating may indicate higher running costs, which could affect the borrower's ability to repay the loan. Therefore, mortgage companies in Stroud heavily rely on EPCs to make informed lending decisions.

How EPCs Benefit Mortgage Companies in Stroud

EPCs offer several benefits to mortgage companies customers in Stroud. Firstly, they provide a clear indication of a property's energy efficiency, allowing mortgage lenders to assess the potential risks and costs associated with the property. This helps them make more accurate lending decisions and mitigate any potential financial risks. Additionally, EPCs can also be used as a marketing tool for mortgage companies. By promoting energy-efficient properties, mortgage companies in Stroud can attract environmentally conscious customers who are looking for sustainable homes. This can give them a competitive edge in the market.

The Legal Requirements for EPCs in Stroud

In Stroud, as in the rest of the UK, it is a legal requirement for a property to have a valid EPC before it can be sold or rented out. This requirement ensures that buyers and tenants have access to information about the energy efficiency of the property. The responsibility for obtaining an EPC lies with the seller or landlord. Failure to provide a valid EPC can result in fines and legal consequences. Therefore, mortgage companies in Stroud can rely on the legal framework surrounding EPCs to ensure that the properties they finance comply with the necessary regulations.

The Process of Obtaining an EPC in Stroud

Obtaining an EPC in Stroud is a relatively straightforward process. The first step is to contact a qualified Energy Assessor who will visit the property and conduct an assessment. This assessment involves gathering information about the property's construction, insulation, heating systems, and other relevant factors. The Energy Assessor then uses this information to calculate the property's energy efficiency rating. Once the assessment is complete, the Energy Assessor will issue the EPC, which is valid for ten years. Mortgage companies in Stroud can rely on this process to ensure that the properties they finance have up-to-date and accurate EPCs.

The Value of EPCs for Homebuyers and Sellers in Stroud

EPCs hold significant value for both homebuyers and sellers in Stroud. For homebuyers, an EPC provides valuable information about the energy efficiency of a property. It allows them to compare different properties and make informed decisions based on their energy consumption preferences. Homebuyers can also use the EPC rating to estimate running costs and potential savings on energy bills. For sellers, an EPC can enhance the marketability of their property. A higher energy efficiency rating can attract environmentally conscious buyers and potentially increase the property's value. Therefore, EPCs are a valuable tool for facilitating transactions in the real estate market in Stroud.

The Role of EPCs in Energy Efficiency and Sustainability Efforts in Stroud

Stroud, known for its commitment to sustainability, places significant emphasis on energy efficiency. EPCs play a vital role in supporting energy efficiency and sustainability efforts in the town. By providing clear information about a property's energy performance, EPCs encourage property owners to invest in energy-saving measures. This, in turn, helps reduce carbon emissions and promote a greener environment. Mortgage companies in Stroud can align themselves with these values by promoting energy-efficient properties and contributing to the town's sustainability goals.

How Mortgage Companies in Stroud Can Utilize EPCs to Attract Customers

Mortgage companies in Stroud can leverage the power of EPCs to attract customers. By partnering with qualified Energy Assessors and offering EPC services, mortgage companies can provide a one-stop solution for potential homebuyers. They can educate customers about the benefits of energy-efficient properties and guide them through the process of obtaining an EPC. This added value can position mortgage companies as trusted advisors and attract environmentally conscious customers who prioritize energy efficiency. By embracing EPCs, mortgage companies in Stroud can differentiate themselves from their competitors and build long-term relationships with their customers.

The Benefits of Using myEPC Platform for EPC Services in Stroud

To streamline the process of obtaining EPCs, mortgage companies in Stroud can utilize the myEPC platform. myEPC offers fast turnaround times, great rates, and experienced surveyors. By partnering with myEPC, mortgage companies can ensure that their customers receive accurate and up-to-date EPCs in a timely manner. The platform also provides additional services such as EPC renewal reminders, helping mortgage companies stay on top of their EPC requirements. With its user-friendly interface and efficient processes, myEPC is the ideal solution for mortgage companies in Stroud seeking reliable EPC services.

Conclusion: Unlocking the Value of EPCs for Mortgage Companies in Stroud

EPCs play a pivotal role in the mortgage industry in Stroud. They provide essential information about a property's energy efficiency, allowing mortgage companies to make informed lending decisions. EPCs also benefit homebuyers and sellers by promoting energy efficiency and contributing to sustainability efforts in the town. Mortgage companies can leverage the value of EPCs by partnering with qualified Energy Assessors and utilizing platforms such as myEPC. By embracing EPCs, mortgage companies in Stroud can attract customers, differentiate themselves in the market, and contribute to a greener and more sustainable future.

If you require an EPC and are based in Stroud, Gloucester, Cirencester, or Cheltenham, including surrounding villages, please contact us. We offer fast turnaround, great rates, and experienced surveyors. Walk us through Ltd.